Ty’s Take April 2019

First, I want to thank all of the people who made our video series a resounding success. As of the time I'm writing this, one of the videos has almost 2,500 views, and several of them top 1,000. So thank you!!!

This month seemed relatively uneventful has a whole, but certainly reflected some undercurrents playing out in the market. However, I think we are seeing some of the most interesting changes in the oil industry in the past decade beginning to unfold.

Iran Sanctions Waivers

The first is the U.S. decision to not renew sanctions waivers for Iranian oil.If that truly surprised anyone, I'm surprised that they are surprised. Yet. Traders seemed surprised. But what is interesting to me is the great lengths the White House and State went to insure everyone that oil markets are well supplied.And the fundamental gap between what the U.S. government and Saudi Arabia believe vs what oil traders believe.

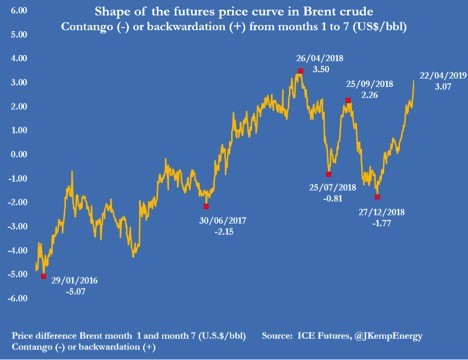

BRENT's six-month calendar spread has hit $3.07 backwardation, the highest since Mar-Apr 2018 (when Iran sanctions were also high on the agenda) and before that Jun 2014 (when Libya's production was interrupted by civil war and Islamist fighters were racing across northern Iraq):

Oil traders just don't believe that the market is heading into the second half of the year well supplied.And while Saudi Arabia and the United Arab Emirates joined with the U.S. in issuing a joint statement and pledged to makeup the output, I think traders are cynical: believing that they will instead wait to see lower global inventories before stepping up production.

Now, late last week and beginning this week, hedge funds softened their long positions causing a decrease in the oil price.

Shale Consolidation.

The other issue that I found of great interest this month is Chevron's bid for Anadarko, and then Occidental's attempt to up the ante.

Chevron planned to acquire Anadarko Petroleum in a cash and stock deal the company valued at $33 billion.

- The transaction values Anadarko at $65 per share, a 37% premium to Thursday's closing price.

- Chevron's deal represents the 11th biggest ever for an energy and power company, according to Refinitiv.

- The transaction would provide additional benefits as it would give Chevron significant contiguous land holdings in the Permian.

While Occidental had been a contender for the deal, Chevron ultimately bested them.Until this past week.Occidental said in a letter to Anadarko's board on Wednesday that its bid is worth $76 per share in cash and stock and would give Anadarko shareholders $38 in cash and 0.6094 shares of Occidental stock for each Anadarko share.

Occidental puts the value of its proposal at $57 billion, including debt and book value of non-controlling interest. Chevron's deal was valued at $33 billion in cash and stock, or $50 billion including debt and book value of non-controlling interest.

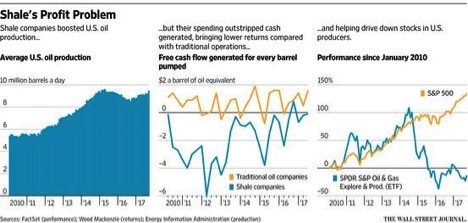

But as I discuss in the article this week, and first discussed in the article on the parent-child problem shale companies are experiencing: shale oil has a problem.Specifically, a profitability problem.And it doesn't seem to be going away – even with oil trading at a good number.

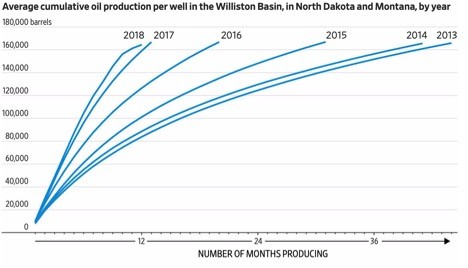

Something interesting got reported this month: lighter, sweeter crude is trading at a discount under standard WTI. While that did not deserve an article in and of itself – its significance cannot be underestimated. Whereas historically refiners were willing to take these crudes and weren't really differentiating – as the market becomes saturated with light/sweet and heavy sour is in shorter supply, refiners are less willing to be so accepting.This spells trouble for the shale players who rushed into production on some of these newer wells – as one consequence seems to be that they are producing lighter and sweeter crudes.

Is this the beginning of a wave of consolidation? I strongly suspect it may be.I believe the oil company of the future is well-rounded with a diverse portfolio of long and short cycle plays across a wide variety of basins. Shale wells will be strategically deployed to take advantage and maximize profits when oil prices are high – not as the only source of revenue. So stay tuned for that: because I think the overall long-term implications over the next five years could be hugely significant.

And of course. My favorite topic of the month: earnings. I strongly encourage you to listen to this Month's Earnings Video as I condense the 3 hours+ of earnings calls into less than 20 minutes. But of the points I took overall, the following few were the most significant:

Offshore is definitely coming back – particularly shallow water.

North America is down, but international is up.

Everyone had a soft first quarter, but doesn't expect much further slackening.

Years of underinvestment in oil infrastructure are starting to take their toll and will continue to extract an ever increasing price for those who don't start to actively invest.

Many of our suspicions were confirmed – OEMs hit the breaks in November/December which lead to a substantial decrease in January and February.But March appeared better.

Reporting a loss is never easy, but in doing so Clay Williams, CEO of NOV, made an interesting comment:

NOV's largest customers, the oilfield service companies that execute well construction plans for these oil companies, in trying to divine what the new year would hold, all seemed to decide that discretion is the better part of valor, and they threw the brakes on their spending for the tools that they buy from NOV.. Oilfield service companies are skilled at slashing spending during market slowdowns and our phones went quiet in December and January… After a very quiet start to the year, we saw orders begin to flow in again in late February and March to support activity. Book to bills' in excess of one for Completion & Production Solutions which booked half its orders in March

I think this corresponded with a lot of the industry feedback I've been hearing. Bookings took a hit in the early part of the year, as oilfield services companies slammed the brakes, and then started to rebound some.

But the comment I want to focus on comes from Paal Kilsgaard of Schlumberger.Asked what would happen if oil stays in the $60-70 range for a prolonged period of time, he responded as follows:

Well, I think if you look at where investment levels were back in the period, 2010 to 2014, obviously internationally now we are still almost around half of those investment levels. And if you were to say that the new normal is somewhere in between where we are and where we used to be, you still need multiple years of not even single-digit but probably double-digit growth in order to get back to the – even the halfway point between investment levels in 2014 and investment levels as of today.

So we still see a fairly decent runway for increased international investments. And you also see the need for this in the production declines that we are now seeing in the mature production base internationally.

And I think that comment is telling. One of the biggest questions we have discussed as a management team at Five Star Metals is-is this the new normal. Was 2018 a great year, and we just didn't know it, or was it a good year that could still be a lot better.

And while Mr. Kilsgaard doesn't really answer that, in a way he does. And I tend to agree.I don't think we will go back to where we were in 2014 anytime in the near future. Nor do I think we will continue at the depressed levels we remain at today. The truth is that massive underinvestment has diminished production around the world. And massive capital expenditure will be necessary to regain that lost production. Oil markets will level out. And I personally believe that shale operators are having massive problems – in particular, they seem to be utterly incapable of generating a profit.Eventually, they have to get off the treadmill of spending all of their cash on new drilling just to keep operations going.

In closing, I maintain my prior market outlook for the year. With one caveat. I don't believe we will see much further softening, and I do believe that there is significant upside.

By accepting you will be accessing a service provided by a third-party external to https://fsmetals.com/