U.S China Tradewar - A Small Business Perspective

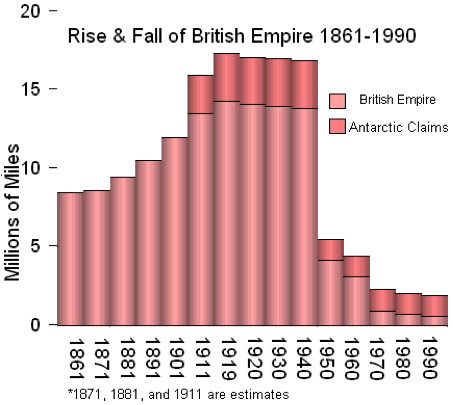

Historical Analogy

While not as large as the British empire, France (including colonies) had approximately 78.8 million inhabitants (approximately 4.6% of world population), at its peak in 1920 controlling 4.4 million square miles of land.

At the time, Germany seemingly paled in comparison – consisting of 56.6 million inhabitants. Indeed, Germany was a relatively new nation, formed by the unification of several German-speaking kingdoms in 1871. We tend to think of Germany as an old country.But it isn't.

However, despite having sizably less territory and inhabitants than Britain or France, Germany had grown a GDP that nearly rivaled that of the United Kingdom.Stated in 1960 US dollars, UK GDP is estimated at 36,273,000,000 while Germany's GDP 35,800,000,000.

And Germany had grown where it matters: in efficiency, in technology, and in industrialization.Utilizing newer technology, Germany had eclipsed Britain as the largest steel producer.While Britain maintained a far superior army (both in terms of training, experience, and then advanced weaponry), the Germans were quickly catching up.

Yet, Britain and France worked diligently to contain the growing power Germany sought to exercise that came with its growing economic power.Many historians attribute the outbreak of World War I to these containment efforts – which is what led to the alliance system.In effect, Germany wanted to disrupt the old guard, and Britain and France wanted nothing to do with that.

Fear of Germany's growing strength encouraged Russia and France to enter into an alliance in 1893. German ambitions to build a battle fleet initiated a naval arms race with Britain that seriously strained relations between the two. Following the age old adage the enemy of my enemy ismy friend, Britain, who had long seen France and Russia as potential enemies, negotiated agreements with them beginning in 1904, aiming to secure its empire by settling colonial disputes. The new and unlikely friendship between these three powers heightened German fears of 'encirclement' and deepened the divide among the European powers. Imperial rifts worsened these divisions and tensions. When Germany tried to oppose a French takeover of Morocco, Britain supported France.

While it is certainly true that the opening salvos of the war were driven by ethnic and other tensions present in the Austrian empire and the assassination of Archduke Ferdinand, the system of alliances is what triggered a major world war.This system of alliances grew from a sort of changing of the guard: Britain and France were watching their power decline, while Germany was increasing.Austria, who actually triggered the war, was also a declining empire.Germany felt encircled in response to Britain and France's efforts of containment: a similar situation to the South China Sea and the Asian region as a whole.

While the analogy is far from precise, China is certainly an old empire, America a relatively new one, there are some eerily similar comparisons.China seeks to modernize its military both via development of carrier based battle groups and through creation of artificial islands to act as stationary aircraft cariers.Germany also sought to increase the size of its Navy, thereby directly challenging the hegemony of British Naval Forces.

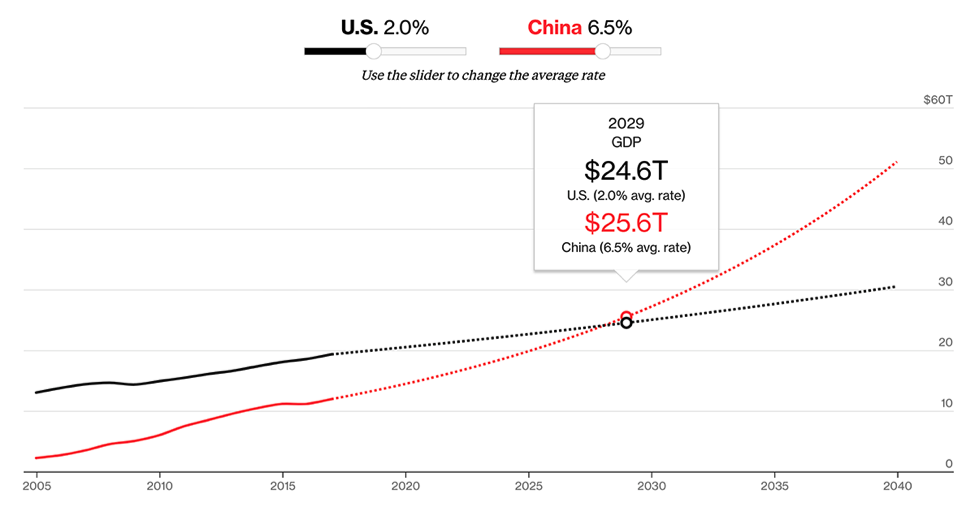

China GDP is rapidly rising, and just like Germany, China seeks more and more influence.In effect, a true seat at the table.

Perhaps strikingly different though – Germany and England might have had differences, but they did not have diametrically different systems.In the case at hand, the United States and China have very different views on numerous issues including personal freedom, the proper role of the state in governance, and the role of the free market.

"When goods don't cross borders, soldiers will."

Historical analogies aside, one of my favorite quotes, often attributed to Frédéric Bastiat (1801-1850), is "When goods don't cross borders, soldiers will."

While the inverse is certainly not true (indeed, while no official figures exist, Germany and Britain certainly had a significant amount of trade leading up to WWI), there are plenty of historical examples of where goods stop flowing and war follows.Trade and commerce link two nations.They create common interests.And they create real costs for war for the general population: disruption of economic systems that effect the entire population.They create risks of strong inflationary pressures, disruptiuon of food and critical supplies, and other problems that act as a direct and strong disincentive to war.

So I am concerned by the current state of Sino-American relations: not just because tariffs effect steel, which I sell, but because a trade war between the United States and China amounts to a cold war – one where the fight is economic but could easily bleed over to an actual battlefield.What's at Stake?

Like many of the commentators who have written on the issue, I would submit that the current trade battle has less to do with the price of soybeans or how many Harleys are sold in China, and more with a strategic balance of power that will effect the World for generations to come.

On the Chinese side, China feels it has earned a seat at the table. After experiencing explosive economic growth and rapidly developing its military and structural powers, China seeks to project more and more influence around the World.

And make no mistake: the World is listening.We recently saw this when Saudi Arabia thumbed its nose at the President of the United States in deciding to continue its current OPEC policies: in effect, Saudi Arabia was saying "We deem China to be a more important partner on a go-forward basis…Thanks for you input but no thank you."

The question is where does China seek to project its growing power: clearly, in Asia.But how far beyond is a little ambiguous. I certainly believe that China seeks to be able to counter U.S. hegemony where it deems it sufficiently in its interest. But I'm not sure that China has strong military ambitions outside of that regional sphere. And for good reason: as discussed below – China spends a fraction on its military compared to the U.S., and maintaining global influence like foreign bases is very expensive.

But Asia has been dominated by the United States since the 1970s, and Asian stability has been guaranteed by the United States.China appears to be a disruptive force to that hegemony and the United States is not fading quietly into the night. Where China's ambitions lie is unclear.

The evidence is strong that the United States perceives this trade dispute as substantially more about global hegemony and power rather than simply a trade dispute.

Last month, at a conference in Brussels, U.S. officials warned their European allies to be cautious using foreign technology to build 5G networks – particularly Huawei – the primary Chinese supplier of such technology.

The U.S. voiced concerns over potential backdoors into the network if supplied by a Chinese Company.On its surface, this appears to be just a concern over cybersecurity.

Yet, the United States is part of the Five Eyes signal monitoring network. As it currently exists, the U.S. and its allies have virtually unfettered ability to tap any phone in the World. This ability comes, in part, through its partnerships with equipment manufacturers. So while part of the trade dispute can be viewed as related to trade imbalance and other issues, there is little doubt that some of what is occurring has more to do with containment of China and military objectives.

As we will discuss below, I believe the global balance of power is what is really at stake.China seeks to grow in technology and simultaneously grow in influence, and the U.S. seeks to contain that growth.

But Reality is China is a long way off..

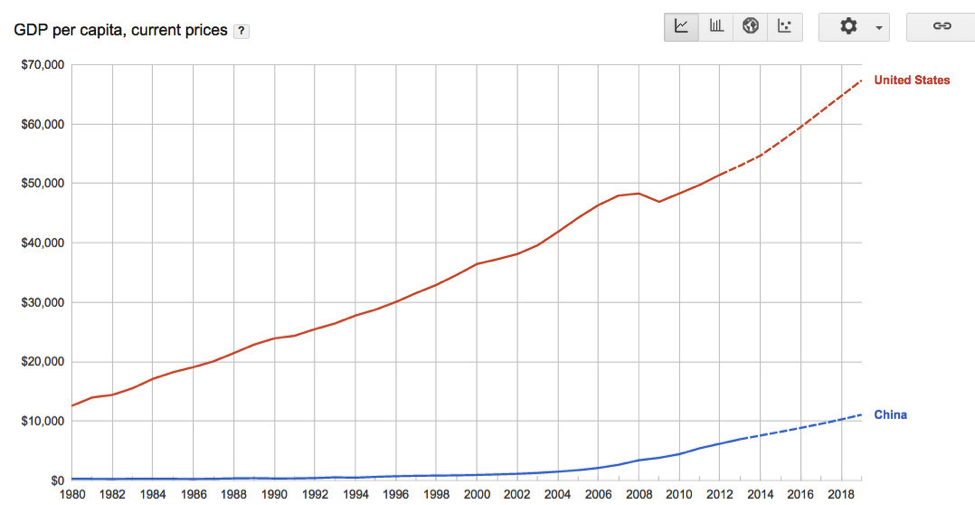

But make no mistake, China is a long way from catching up to the United States.It is certainly true that China's GDP is likely to overtake U.S. GDP by 2030 (it seems that most economists accept this as a foregone conclusion even though it is far from it)…

China's military is a long way from catching up to the United States.Based on estimated defense budgets in 2017, the United States spent approximately $609 billion compared to China's $228 billion. Make no mistake, the Chinese have squeezed a lot out of their money and have rapidly progressed their technology and assets. But that is still quit a difference.And China's military is largely untested and inexperienced: the last major conflict China was involved in was Vietnam in 1979.

Similarly, China lacks an alliance system.NATO alone has 29 members and the United states has substantial good-will in numerous non-NATO countries.In stark contrast, China has little to no alliances.

Cultural influences and aspects.Some of my Chinese friends and I joke: China exports steel, the United States exports culture. And it is true. American culture predominates around the World, including in China. But it is deeper than that.The United States has a far superior educational system – not just in primary school but in terms of top flight Universities. That system took generations to buil

Yet, China has a long way to go in numerous other areas before it will catch up with the United States.Let's take a quick look at the obstacles and issues facing China:

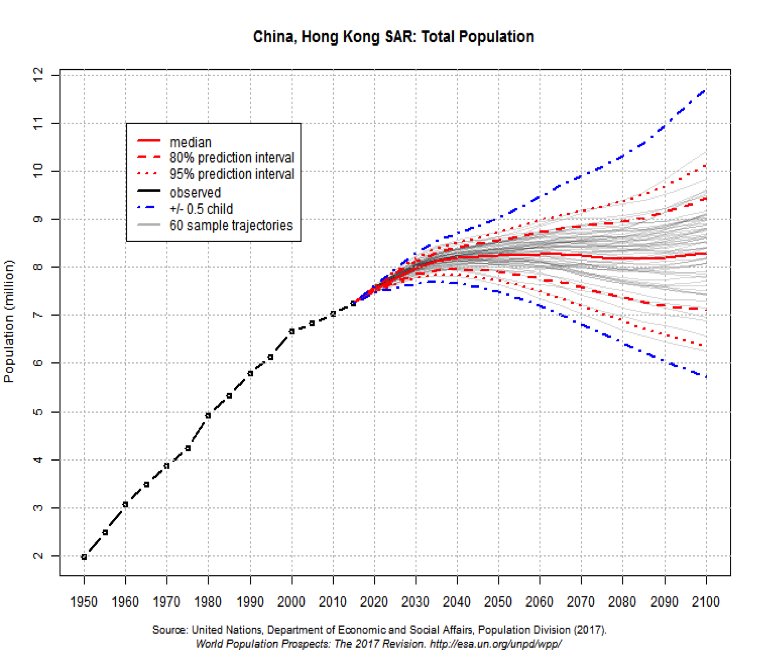

- Negative population curve. China's rise has, in part, come from its rising population of eager and abundant workers. This has spurred huge economic growth (more people consuming more goods and services)and a readily available labor force.However, China's one child policy is about to start having an effect (as a side note: this policy was reversed in the last several years): as early as 2023, China's population is projected to decline.

2. Air pollution and water. Similarly to the problem above, pollution is exerting a huge toll on the Chinese population. Living in some of the most populated areas simply breathing is the equivalent of smoking 2 packs of cigarettes a day.The long term costs associated with this health crisis is tremendous. And that doesn't even begin to touch the issues of clean drinking water: by China's own estimates, China faces a huge water crisis by 2030 – China has 20% of the World's population and only 7% of the fresh water supply to begin with – add pollution and other issues on top of that, and a crisis is brewing.

3. Wage increases/standard of living increases. Both an economic stimulus but also a detriment.As China economic growth has continued, so have wages. Nearly to the point where the actual cost differential (when you add shipping, etc) of some products is approaching parity with the United States. Simply put, workers are starting to demand higher wages and better conditions.This drives up costs. Recently, one of my Chinese friends expressed problems in his business: for the first time, he had workers refusing to work overtime during a national holiday and he's had a hard time finding workers as they are opting for jobs with more flexible schedules. Welcome to first world business management my friend….

4. Emigration.Simply put, China's wealthy are considering moving.Some 50% of China's population is thinking of relocating: and this includes some of their wealthiest citizens.

5. State controlled enterprises. Approximately 30 percent of their total assets (in both the industrial and service sectors) are state-controlled. This may lead to corruption and inefficiency, as subsidies can and are used to prop up businesses which may otherwise be unable to compete. With competition comes innovation, which is essential to maintain relevance in an increasingly high-tech, knowledge-based economy. A whopping 50 percent of total industry in China is state-controlled. But, this is also a strength as it allows China to make fairly planned economic decisions – such as limiting quantity or devoting more resources to projects. But I can see first hand the tension that it creates: many of my friends are being forced to limit their production, etc. (and therefore their own earnings) as the Chinese government diverts resources they need to projects it deems more important.

6. China's hidden debt. While the United States certainly has substantial debt, it also has a low cost of credit because of its known ability to pay. The United States has relatively low tax rates, and thus, lenders are assured that if needed, the US could raise substantial funds to pay its debt.China, on the other hand, has 5.5 - 6.0 trillion dollars in hidden debt used to finance its rapid growth. .

7. Its hold on U.S. debt is a double edged sword. China owns about 7% of U.S. debt.Some believe that enables China to have significant negotiating power. But, the United States seems to have no problems finding people to purchase its debt.Moreover, China's share of US debt represents a significant portion of its total foreign exchange holdings. That gives China a very real vested interest in the strength of the U.S. economy – as does its exports.

In the end, I believe that a growing and strengthening China is somewhat inevitable.

Headwinds Facing a Trade Deal

In the first part of the article, I told you why I think it is so important that the Untied States and China reach a sustainable agreement. I truly believe that trade issues can lead to an outright war, and that it is in neither nations' best interest.

Diametrically Opposing Systems

Yet, fundamental structural barriers exist. Unlike most trade dispute between free market economies, there is little doubt that the U.S. and China have diametrically different system.While China has some free market businesses, state owned enterprises predominate.

Reconciling these two systems is an enormous task. The United States and its like minded allies view China's state run enterprises as negative, and almost that China's growth occurred in spite of its legal, regulatory and cultural framework; whereas China views it has having been key to its success – as evidenced by President Xi who started as a reformer, but has consolidated more and more power in state run enterprises.

The United States has legitimate complaints with the Chinese system ranging from unfair subsidies to state run enterprises to downright theft of intellectual property. Yet, the Chinese system has faired well: for China. Getting them to abandon parts of the system is probably unrealistic.

The Chinese system of state run and owned enterprises is deeply rooted. So whereas the U.S. sees an unfair subsidy given to a Chinese steel mill for example, the Chinese see it as just another extension of their government supporting their economic and militaristic aims.How you reconcile these two is beyond the scope of this article.

And giving them the "seat at the table" becomes more complicated when one considers all of the cultural, political, and economic barriers standing in the way. These include issues of personal freedom, workers' rights, and the role of government in the economy.

Technology is Key

Furthermore, the U.S. is trying to maintain its dominance in certain aspects while China simultaneously seeks to undermine that dominance. For example, President Xi has made it clear: he will not compromise on his "Made in China 2025" initiative.I understand why. China has long been a manufacturing hub. But advanced manufacturing and technology has thus far alluded China. Only in the last few years has China started to develop its own aircraft, for example. President Xi is smart and sees that over the coming decades, more and more emphasis will be on technology – AI for example and advanced manufacturing where China significantly lags.

But the United States is smart as well and knows that in this area, it leads the rest of the World. Simply put, unless Americans want to seriously compromise their standard of living, simplistic manufacturing is gone.But where we can compete is in advanced manufacturing: airplanes, technology, and other areas. For the United States to continue its path, it must continue to develop an educated and highly skilled workforce that excels at manufacturing complex goods.

Unfortunately, this creates an irreconcilable conflict as both parties see the key to their continued ability to exert influence as linked to growing their own complex manufacturing, partially through depriving the other of some of these abilities or creating less market space for the opposing party. Think airplanes: Boeing exports a huge number of airplanes to China. China's demand for such airplanes is continuing to grow. But now, China wants to make those airplanes at home.The United States wants to supply those airplanes. The easy way to reduce the trade deficit is for the U.S. to make airplanes, and China to continue to produce its products. But President Xi wants the technology and the independence.So he's not likely to give much on that point….

Containment and Influence

Part of the issue with Chinese appropriation of intellectual property and its desire to continue growth of more complex and advanced manufacturing is strongly linked to containment of Chinese's influence ambitions.As we see growing tension in the South China Sea, what we are really seeing is a regional soft power battle.

The United States, for example, regularly conducts freedom of navigation exercises in the South China Sea.

But part of this trade dispute is a tacit recognition by the Untied States that to maintain its military superiority it needs to maintain its technological superiority.So intellectual property and issues surrounding government appropriation of that property are tremendously vital.

In effect, the United States seeks a containment policy through delaying China's acquisition of some of its most advanced technologies.

Final Thoughts…

I fundamentally believe that one of the most important issues facing the World is the relationship between China and the United States.And I fundamentally believe we are disguising a battle for the future as a trade war.

While there are certainly issues that need to be resolved and the United States has many legitimate issues with China – the trade imbalance is not the primary concern.Nor should it be.The real issue is technology, complex manufacturing, and all the implications that flow therefrom from a military and strategic perspective.

And certainly, trade deficit matter. But how much is a question reasonable minds can differ on.I would urge you to read this article from CNBC that discuss both sides of the analysis of whether a large trade deficit is really a bad thing: https://www.cnbc.com/2019/01/24/us-china-trade-war-do-bilateral-trade-deficits-matter.html.

Nevertheless, U.S. hegemony was a result of right time, right place.Simple economic growth does not guarantee super power status. If it did, Japan would be a super power. The United States occupied an interesting position post-WWII. The developed world was in disarray.Both sides needed someone they could trust, and that was the United States.In 1944, world leaders agreed to anchor their exchange rates in gold, which would then be tied to the U.S. dollar. As a result, the U.S. dollar became the most important currency in the world, and the United States rose to superpower status. China has no one clamoring to create such a framework. While Americans are often a bit unfocused when it comes to these issues, part of what allows America to exert its influence is that a lot of the World trusts us to act fairly and justly. China, right now, is largely viewed in the Western world with suspicion.

China justifiably wants a seat at the table. But that is harder to give when the two parties have diametrically opposed systems of government, etc. Nevertheless, it is imperative that an agreement be reached not just for trade and jobs, but for ongoing peace and prosperity.

Sourcing for this article:

A quick note on sourcing.For most of my articles, I actually utilize numerous sources, but I do not feel a need to provide a list.Because this topic is so in-depth and complex, I thought I would provide you all some sourcing notes so that readers interested in doing their own in-depth analysis might be able to do some further reading:

China to increase EP:https://www.reuters.com/article/us-china-oil-exploration-analysis/drill-china-drill-state-majors-step-on-the-gas-after-xi-calls-for-energy-security-idUSKCN1PQ3PO

Us business wants deal: https://www.wsj.com/articles/pressure-grows-on-u-s-china-to-forge-trade-deal-11549571879

http://www.xinhuanet.com/english/europe/2019-02/08/c_137805588.htm (hawuai safe tech)

More on tech and cyber security:https://www.ft.com/content/76e846a4-2b9f-11e9-9222-7024d72222bc

did us overshot: https://www.reuters.com/article/global-economy-kemp/column-us-may-have-overshot-in-china-trade-talks-kemp-idUSL5N20D3O8

not about trade: https://www.project-syndicate.org/commentary/us-china-trade-deal-security-by-minxin-pei-2019-02

some of the things at stake/opposition at home:https://www.wsj.com/articles/u-s-bets-on-chinas-special-envoy-in-trade-talks-11550795104

complications/ag example: https://www.nasdaq.com/article/china-must-balance-us-trade-deal-with-fostering-its-own-ag-sector-20190222-00048

huwui perspective: https://www.ft.com/content/b8307ce8-36b3-11e9-bb0c-42459962a812

PAULSON take (very interesting):http://www.paulsoninstitute.org/news/2018/11/06/statement-by-henry-m-paulson-jr-on-the-united-states-and-china-at-a-crossroads/

Do trade deficits matter: https://www.cnbc.com/2019/01/24/us-china-trade-war-do-bilateral-trade-deficits-matter.html

Related Videos

Related Posts

By accepting you will be accessing a service provided by a third-party external to https://fsmetals.com/